Single-Family Rental Hotspots (and Cold Markets) Ranked by Gross Yield

April 3, 2025

A beautiful 3-bedroom, 1,720-square-foot brick home in Seattle’s Broadview neighborhood—ranked as one of the best places to live in Washington—was recently listed for rent at approximately $4,000 per month. Homes in this area typically sell for between $800,000 and $1.3 million, and this particular property is valued at $1 million by Redfin.

Roughly 2,000 miles southeast in Dallas, you can rent a beautifully renovated 3-bedroom, 1,770-square-foot craftsman-style home in a desirable neighborhood for the exact same monthly rent. However, home prices in that area average around $500,000.

While this may seem like an extreme case—especially since many investors tend to avoid single-family homes priced over $1 million—it highlights the significant variation in gross rental yields across the country. Though factors like appreciation potential, local taxes, and operating costs also play a role in investment decisions, there are many markets with similar fundamentals, but drastically different gross rental income returns.

If you're thinking about investing in single-family rentals, where you buy can make or break your cash flow. Our research team analyzed average rental prices for single-family homes using data from our extensive database and compared them to average home prices in each city (sourced from Zillow) to identify the U.S. cities with the best—and worst—rental yields, a key metric for real estate investors.

Rental yield (also known as the rent-to-price ratio) is calculated by dividing the annual rental income by the property's purchase price. It helps investors gauge how much income a property generates relative to its cost. This metric represents the annual return on investment before accounting for expenses, taxes, or other associated costs.

For renters and aspiring homebuyers, this metric can also be very helpful. In many cases, cities with higher rental yields may indicate markets where buying a home makes more financial sense than renting. Conversely, in low-yield cities, renters may actually be better off continuing to rent, as monthly rent can be relatively affordable compared to mortgage costs. As with any property investment decision, it’s important to also consider factors like interest rates, taxes, and local market conditions.

Let’s break down the top- and bottom-performing markets based on rental yield.

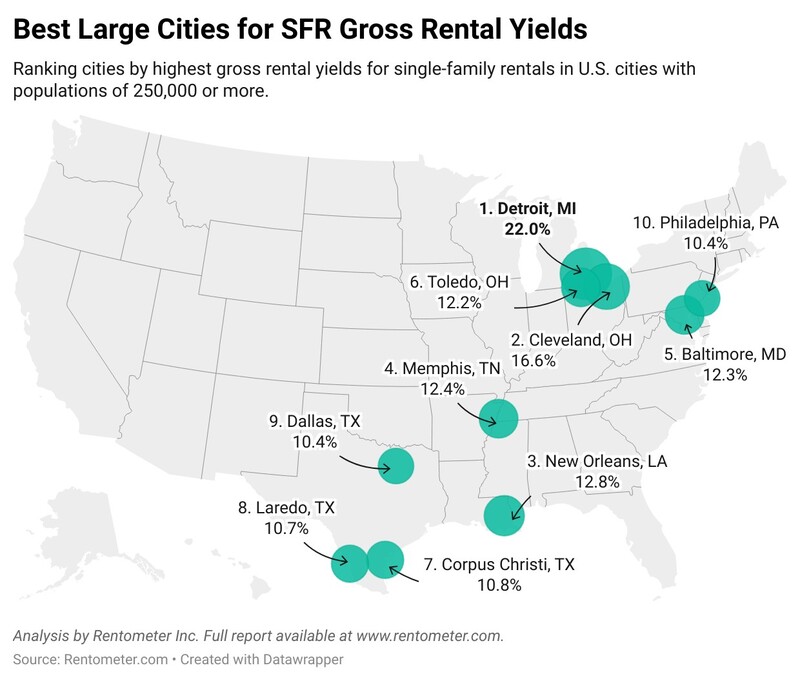

Best Large Cities for Rental Yield

These cities offer some of the highest returns in the country—meaning your investment dollar goes a long way.

1. Detroit — 21.95% Yield

With an average home price of just $71,503 and an average monthly rent of $1,308, Detroit tops the list for rental yield among large U.S. cities. Despite decades of economic challenges and population decline, the city’s low property prices and solid rental demand have made it a hotspot for cash-flow-focused investors.

There are also many signs of an exciting turnaround—major companies and retailers are investing in the area, and in a historic shift, Detroit’s population grew in 2023 for the first time in decades.

Things to watch for: Property taxes in Detroit are relatively high, and crime remains a concern in some neighborhoods.

2. Cleveland, OH — 16.59% Yield

Cleveland offers a strong yield thanks to a solid renter base, with average rents for single-family homes at $1,500 and average home prices around $110,000—much more affordable than many other parts of the country.

With a revitalized downtown and improving infrastructure, Cleveland remains a solid option for buy-and-hold investors. According to Mortgage Professional America, a growing number of out-of-state investors are driving demand in Cleveland's housing market, attracted by its low entry prices and steady rental income potential.

Things to watch for: Cleveland has some of the highest property taxes in Ohio, and they remain above the national average.

3. New Orleans, LA — 12.77% Yield

New Orleans might be better known for its culture than its cash flow, but the data tells a different story. With average rents over $2,400 and homes just above $225K, it delivers a strong yield. That said, investors should be mindful of hurricane insurance costs and zoning restrictions related to short-term rentals.

Things to watch for: Insurance premiums are among the highest in the country, and continued population decline may affect long-term growth prospects and property appreciation.

4. Memphis, TN — 12.44% Yield

Memphis consistently ranks well for rental investors, with average single-family rents nearing $1,400 and average home prices around $209,000—still relatively affordable compared to many U.S. cities.

The city has a high percentage of renters (about 53% of households), making it attractive for investors targeting long-term tenants. Memphis continues to benefit from its role as a major logistics hub, anchored by FedEx and other large employers, which supports steady housing demand and job growth. Recent significant investments in the Memphis metropolitan area, such as Elon Musk's xAI supercomputer project and Ford's BlueOval City, are expected to further bolster the region's economic growth and employment opportunities.

Things to watch for: Rental vacancy rates in the Memphis metro area were among the highest in the country as of late 2024, and demographic growth remains modest at the metro level—with population declines within the city limits.

5. Baltimore, MD — 12.30% Yield

With average single-family home prices around $181,600 and single-family rents nearing $1,862, Baltimore offers strong rental yields for investors seeking cash flow in a major East Coast market.

The city’s relative affordability—especially compared to nearby Washington, D.C. and its pricey suburbs—makes it appealing to both local and out-of-state investors. Baltimore also benefits from a solid renter base and proximity to major employers and institutions, including Johns Hopkins University and the Port of Baltimore.

Things to watch for: Crime remains a concern in some neighborhoods, though progress has been made—2024 recorded the lowest level of violent crime since 2015. The city is also experiencing net population outflow, which may affect long-term housing demand and property appreciation in certain areas, and higher than average property taxes.

Other Notable High-Yield Cities

-

Toledo, OH – 12.22% yield with extremely affordable homes and stable rent prices.

-

Corpus Christi, TX – 10.80% yield in a growing Texas city with coastal appeal.

-

Laredo, TX – 10.70% yield in a key border city with strong rental demand.

-

Dallas, TX – 10.42% yield—a good balance of rent and property value in a booming city and metro area.

-

Philadelphia, PA – 10.40% yield with a large renter population and diverse neighborhoods.

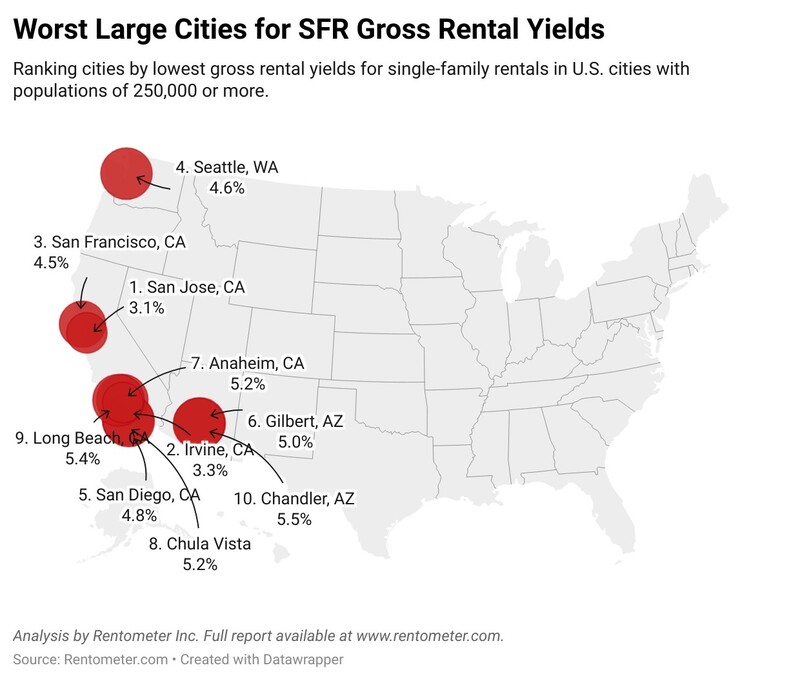

Worst Large Cities for Rental Yield

At the other end of the spectrum are some of the country’s most expensive cities—where home prices have outpaced rents dramatically.

1. San Jose, CA — 3.08% Yield

With a jaw-dropping average sale price of over $1.6 million and average monthly rent of $4,148, San Jose ranks lowest in the country. Despite its position in the tech-rich Silicon Valley, the rental income doesn’t come close to justifying the property prices—unless you're banking on long-term appreciation.

2. Irvine, CA — 3.33% Yield

Irvine, a city in Orange County that frequently ranks among the best places to live in California, is known for its high home values and rental rates—but despite strong demand, rental yields remain among the lowest nationwide. With average home prices approaching $1.8 million, investors focused on cash flow may find it difficult to justify the steep upfront cost.

3. San Francisco, CA — 4.47% Yield

Though rents are high—among the highest nationwide, according to our 2024 report—home prices are even higher. San Francisco remains a high-barrier market, with ongoing population shifts, regulatory hurdles, and strong tenant protections that can complicate returns.

4. Seattle, WA — 4.63% Yield

Seattle's market remains hot, but it's not a cash flow city. With prices nearing $1 million, investors are betting on appreciation and equity growth more than monthly income.

5. San Diego, CA — 4.83% Yield

Despite strong demand, San Diego's high property prices have eroded rental yields. The city remains a better fit for long-term investors banking on value growth rather than short-term returns.

Full List of Rental Yields in Large Cities

Below is the full list of major U.S. cities and their respective rental yields:

Mid-sized Cities with the Highest Rental Yields

While large cities often get the spotlight, many midsized markets across the U.S. quietly offer better investment opportunities—especially when it comes to cash flow.

Lower property prices combined with solid rental demand can result in significantly higher gross rental yields compared to major metros. For investors focused on steady income rather than long-term appreciation alone, these cities can deliver strong returns with less upfront capital. Below are five midsized cities leading the pack in rental yield, based on average home prices and rents.

1. Jackson, MS — 20.5% Yield

Jackson boasts the highest yield among midsized cities, with home prices averaging just $70,094 and monthly single-family rents at $1,197. This exceptionally low cost of entry and strong rent-to-price ratio make it a standout for investors focused purely on cash flow. However, challenges such as infrastructure concerns, high vacancy rates (12% as of last quarter), and a shrinking population may require extra due diligence.

2. Birmingham, AL — 14.9% Yield

Birmingham stands out for its exceptionally strong yield, thanks to low home prices (just over $120,000) and solid rental income. The city has become increasingly attractive to investors due to its revitalized downtown, affordable housing stock, and emerging tech and medical sectors. However, the 15.1% vacancy rate is one of the highest in the country.

3. Beaumont, TX — 12.7% Yield

Located near the Gulf Coast, Beaumont offers solid yields driven by low home prices and above-average rents. With homes averaging $151,196 and rents around $1,603, the numbers work well for cash flow. The city’s energy sector presence and proximity to Houston contribute to rental stability.

4. Brownsville, TX — 12.2% Yield

With average home prices just under $191,000 and strong rental demand driving average rents to $1,932, Brownsville offers an attractive yield for investors. The city benefits from its location near the U.S.-Mexico border and a growing logistics and manufacturing sector. Affordability and steady demand make it a promising market for cash-flow-focused investors.

5. Peoria, IL — 12.2% Yield

Peoria combines low entry costs—home prices average just $124,911—with relatively strong rental income around $1,266 per month. The city offers appealing returns in a stable Midwestern market, particularly for investors targeting affordable housing. A stable job market supports continued rental demand.

Mid-sized Cities with the Worst Rental Yields

Not all rental markets offer promising returns—especially in some of the nation’s most expensive midsized cities. Despite commanding high rents, cities like Sunnyvale, Bellevue, and Santa Clara suffer from extremely high home prices that dramatically suppress rental yields. For investors focused on cash flow, these markets are some of the toughest in the country, with yields hovering below 3%. Here are five midsized cities where high acquisition costs make single-family rentals especially difficult to justify from a return-on-investment perspective.

1. Sunnyvale, CA — 2.23% Yield

Sunnyvale has the lowest rental yield among midsized cities, with average home prices topping $2.4 million and average rents at $4,534. Despite its location in the heart of Silicon Valley, rental income simply doesn’t keep pace with property costs. Investors here are banking almost entirely on long-term appreciation.

2. Bellevue, WA — 2.69% Yield

Located just outside Seattle, Bellevue is a highly desirable market with tech-driven demand and strong housing competition. But with home prices nearing $1.73 million and average rents under $3,900, the returns don’t pencil out for cash flow investors. Low yields and high buy-in make it a tough sell for rental-focused strategies.

3. Fremont, CA — 2.70% Yield

Fremont combines high real estate values with only moderate rental income, resulting in a rental yield under 3%. Though it benefits from proximity to major Bay Area employers, the nearly $1.7 million average home price puts pressure on returns. Like other Silicon Valley cities, it's better suited for appreciation plays.

4. Santa Clara, CA — 2.80% Yield

With average home prices just under $2 million and rents around $4,500, Santa Clara remains a challenging market for rental investors. Despite being home to major tech companies, the cost-to-rent ratio is steep. High prices, low yield, and local regulations all add to investor headwinds.

5. San Mateo, CA — 3.25% Yield

San Mateo's strong rental demand is overshadowed by its nearly $1.9 million average home price. Rents average $5,106 per month, but that still isn’t enough to produce strong returns. While the area has long-term appeal, it’s one of the least attractive markets for cash-flow-focused investors.

Full List of Rental Yields in Mid-Sized Cities

Below is the full list of mid-sized U.S. cities and their respective rental yields:

Top Rental Yields in Small U.S. Cities

Small cities may not always grab national headlines, but when it comes to rental yields, they often outperform larger, more established markets.

Many of these cities offer the perfect combination of low entry prices and solid rental demand—resulting in yields that are hard to match in coastal or high-growth metros. Places like Flint, MI (22%), Youngstown, OH (23%), and Gary, IN (20%) top the list with exceptionally high gross rental yields, thanks to home values under $100,000 and average monthly rents that remain surprisingly strong.

These markets are attractive for investors focused squarely on cash flow and long-term income, rather than rapid appreciation. However, as with any real estate investment, investors should conduct thorough due diligence when considering these markets—smaller cities can be more susceptible to economic fluctuations, higher vacancy rates, and often demand more active property management or strong local knowledge.

On the other end of the spectrum, affluent small cities in California—like Palo Alto, Los Altos, and Saratoga—have some of the lowest rental yields in the country, hovering around just 2%. Despite sky-high rents, home prices in these areas are so elevated that they suppress returns significantly.

For investors, this creates a clear contrast: high-yield opportunities are often found in overlooked, affordable cities in the Midwest and South, while low-yield, high-cost markets may only appeal to buyers banking on long-term appreciation and wealth preservation.

Full List of Rental Yields in Small Cities

Below is the full list of small U.S. cities and their respective rental yields:

Final Takeaway

Investors focused on cash flow will find strong opportunities in cities like Detroit, Cleveland, and Memphis, along with many other midsized markets across the South and Midwest—where rents are solid and home prices remain relatively affordable. On the other hand, appreciation-driven buyers may still gravitate toward California’s coastal cities, though those markets typically require a longer investment horizon and deeper capital reserves.

Wherever you’re looking to invest, be sure to factor in elements like property taxes, insurance premiums, local regulations, and long-term appreciation potential. Real estate is highly local, and prices or trends can vary significantly even within the same city. If you're not sure where to begin, Rentometer’s hyperlocal rent comps and quarterly rental reports can give you the data and confidence to make informed investment decisions.

Methodology

This research was conducted by Rentometer.com in March 2025. Rental data is based on Rentometer.com’s extensive database of rent comparables and reflects monthly averages for 3-bedroom single-family homes across over 800 U.S. cities. The data includes listings collected and updated between January 1 and December 31, 2024. Rentals priced below $500 or above $10,000 were excluded from the analysis.

Home prices were sourced from the Zillow Home Value Index (ZHVI) for single-family homes, published at the city level as of February 2025. According to Zillow, this value reflects the typical price range for homes between the 35th and 65th percentiles.

Vacancy data referenced in the report is based on the latest Census estimates, representing Q4 2024 metro-level vacancy rates for both apartments and single-family homes.

Gross rental yield was calculated by dividing the estimated annual rental income (based on monthly averages) by the average home price.

Disclaimer

This report is for informational purposes only and should not be considered financial or investment advice. Gross rental yield calculations are based on in-house and publicly available data and estimates and may not reflect actual market performance or individual property outcomes. Always consult with a licensed real estate or financial professional before making investment decisions.

About Rentometer

Rentometer is a Boston-based company that has been providing investors and real estate professionals with rent estimates and comps for over 15 years. Our company collects and analyzes over 10 million new rental records each year, which form the basis of our market reports.

For over the past two years, Rentometer has closely tracked and reported on three-bedroom single-family home rentals. Single-family home rentals house 41% of the U.S. renter population, and three-bedroom single-family homes are a preferred option for many families and investors.

Rentometer was founded by two seasoned real estate entrepreneurs:

Mike Lapsley is a proptech veteran with over 25 years of experience in the rental housing industry. Prior to Rentometer, he was the CEO of RentGrow, a leader in automated resident screening systems, which was successfully acquired by Yardi Systems. Mike holds a BS in Business Management and Accounting from the University of Lowell.

Torrence C. Harder has over forty years of experience investing in entrepreneurial companies. He founded Harder Management Company, Inc., which has founded and ventured sixteen companies. Torrey holds a BA with Honors from Cornell University and an MBA with Honors from the Wharton School of the University of Pennsylvania.

Explore Rents in Your Local Market with Rentometer

Rentometer provides hyperlocal, accurate rental data that helps you move forward with confidence. Make data-driven real estate decisions today!

Get Started